I've witnessed countless families face unexpected tax burdens when transferring digital assets across generations. The stark differences in European inheritance tax regimes can mean the difference between preserving your Bitcoin wealth and watching significant portions disappear to tax authorities.

Today, we'll examine the inheritance tax landscapes of Belgium, France, Luxembourg, and the Netherlands, analyzing how your fiscal residency choice and family relationships can dramatically impact your Bitcoin legacy planning.

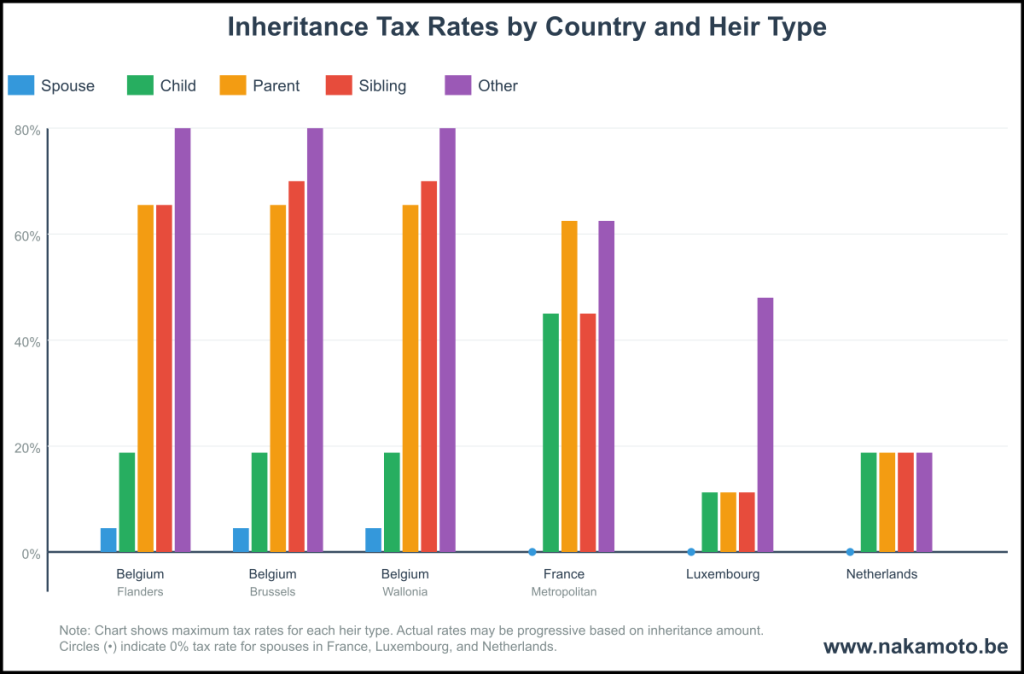

The European Inheritance Tax Landscape: A Tale of Four Systems

Belgium: The Complex Progressive Giant

Belgium operates the most complex inheritance tax system in our analysis, with rates varying significantly across its three regions:

Flanders and Wallonia:

- Spouses: 3-18% (relatively modest)

- Children: 3-30% (moderate progression)

- Parents/Siblings: 30-65% (steep rates)

- Other relationships: 80% (punitive)

Brussels:

- Similar structure but slightly different thresholds

- Siblings face marginally higher rates (35-70%)

Key Insight: Belgium's system heavily penalizes wealth transfers outside the immediate family circle. For Bitcoin holders with significant digital assets, this means careful planning around family structures is crucial.

France: The Spouse-Friendly System

France presents a more balanced approach:

- Spouses: 0% (complete exemption)

- Children: 5-45% (moderate to high)

- Parents: 35-60% (significant burden)

- Siblings: 35-45% (moderate)

- Others: 60% (high but not extreme)

Strategic Advantage: The spousal exemption makes France attractive for married Bitcoin holders seeking to preserve wealth within the family unit.

Luxembourg: The Moderate Middle Ground

Luxembourg offers the most balanced system:

- Spouses: 0% (complete exemption)

- Children: 0-22% (very favorable)

- Parents/Siblings: 6-22% (reasonable)

- Others: 48% (moderate penalty)

Bitcoin Advantage: Luxembourg's moderate rates across all relationships make it attractive for complex family structures and business partnerships involving digital assets.

Netherlands: The Simplified Approach

The Netherlands maintains a straightforward system:

- Spouses: 0% (complete exemption)

- All other relationships: 10-30% (uniform treatment)

Planning Benefit: The simplified structure reduces complexity in Bitcoin estate planning while maintaining reasonable rates.

Fiscal Residency: The Game-Changing Decision

The Luxembourg Advantage for Bitcoin Families

Consider the Mueller family scenario: A Bitcoin entrepreneur with €2 million in digital assets planning to leave inheritance to multiple children and grandchildren.

In Belgium (Flanders):

- Children would face 27-30% rates

- Grandchildren (classified as "other") would face 80%

- Total family tax burden: Potentially €1.2-1.4 million

In Luxembourg:

- Children would face 14-22% rates

- Grandchildren would face 48%

- Total family tax burden: Approximately €600-800k

Savings through residency planning: €400-600k

The French Spouse Strategy

For married Bitcoin holders, France's spousal exemption creates unique opportunities:

- Immediate Transfer: Full Bitcoin portfolio passes tax-free to surviving spouse

- Generational Planning: Spouse can then implement strategic gifting to children over time

- Tax Optimization: Utilize annual gift allowances to minimize future inheritance taxes

Cross-Border Complexity: When Heirs Live in Different Countries

Modern Bitcoin families often span multiple jurisdictions. Consider these scenarios:

Scenario 1: Belgian Resident, Dutch Heirs

- Belgian inheritance tax rates apply

- Dutch heirs may face additional reporting obligations

- Double taxation treaties provide some relief but complexity remains high

Scenario 2: French Resident, Multiple Jurisdictions

- French rates govern the inheritance

- Heirs must navigate both French and local tax obligations

- Bitcoin's borderless nature adds compliance complexity

Strategic Implications for Bitcoin Inheritance Planning

Residency Timing as a Fundamental Planning Tool

Tax residency rules typically require genuine residence for inheritance tax purposes, making the timing of any relocation crucial for Bitcoin holders. Luxembourg generally requires six or more months of annual residence to establish tax residency, while France employs complex rules that consider multiple factors beyond simple physical presence. The Netherlands operates under a 183-day rule combined with additional ties tests, and Belgium requires both residence and the establishment of one's center of vital interests within the country. The key insight for Bitcoin estate planners is that these residency requirements cannot be manipulated at the last minute - they require genuine, long-term commitment to establish.

Understanding the Universal Relationship Gradient

The data reveals a consistent "relationship gradient" across all jurisdictions that fundamentally shapes inheritance planning strategies. Spouses receive the most favorable treatment, facing rates between zero and eighteen percent maximum across all countries studied. Children experience moderate treatment with rates ranging from zero to forty-five percent, while parents face higher rates spanning six to sixty-five percent. Siblings encounter similar treatment to parents with rates between six and seventy percent, and all other relationships face the most punitive taxation at thirty to eighty percent. This gradient creates clear incentives to structure digital asset holdings in ways that maximize transfers to the most favored relationship categories while minimizing exposure to the highest rate brackets.

Progressive Tax Systems and Planning Opportunities

Belgium's highly progressive tax system creates unique planning opportunities that don't exist in flatter rate structures. The steep progression allows for sophisticated strategies involving the spreading of Bitcoin transfers over time to avoid higher tax brackets, the strategic use of multiple beneficiaries to keep individual inheritances within lower rate tiers, and careful timing of transfers to optimize the overall tax burden. These strategies become particularly valuable when dealing with highly volatile assets like Bitcoin, where timing can significantly impact both the asset value and the applicable tax brackets.

Practical Recommendations for Bitcoin Inheritance Planning

Strategies for High-Net-Worth Bitcoin Holders

High-net-worth individuals holding significant Bitcoin positions should strongly consider Luxembourg residency due to its balanced rates across all relationship types, making it particularly valuable for complex family structures. French residency becomes especially attractive for married Bitcoin holders who prioritize spousal wealth transfers, given the complete exemption available to surviving spouses. Belgian residency should generally be avoided from a pure tax optimization perspective unless compelling personal, business, or lifestyle factors outweigh the significant tax disadvantages, particularly for those planning transfers beyond immediate family members.

Multi-Generational Bitcoin Wealth Transfer

Luxembourg's moderate rate structure makes it the optimal jurisdiction for grandparent-to-grandchild Bitcoin transfers, where the "other relationship" classification in most countries would trigger punitive rates. Effective planning requires careful structuring of holdings to minimize classifications that fall into the "other relationship" category, often through intermediate transfers or strategic timing. Trust structures should be evaluated where legally permissible, though Bitcoin's unique characteristics as a bearer instrument create specific challenges in traditional trust arrangements that require specialized expertise.

Cross-Border Family Considerations

International families require comprehensive mapping of all relevant jurisdictions affecting both the decedent and various heirs, as the interaction between different tax systems can create unexpected liabilities or opportunities. Professional engagement with tax specialists familiar with cross-border inheritance and cryptocurrency compliance becomes essential, as the complexity far exceeds traditional estate planning. The timing of any residency changes must be carefully coordinated with anticipated inheritance events, as last-minute relocations rarely achieve the desired tax benefits and may trigger additional scrutiny from tax authorities.

The Bitcoin-Specific Considerations

Valuation Challenges

Bitcoin's volatility creates unique valuation issues:

- Valuation date: Death date vs. distribution date

- Exchange rate considerations: EUR vs. BTC valuations

- Multiple wallet complexity: Aggregating various holdings

Compliance and Reporting

Each jurisdiction has specific cryptocurrency reporting requirements:

- Belgium: Complex regional variations

- France: Detailed digital asset declarations

- Luxembourg: Moderate reporting requirements

- Netherlands: Simplified but strict compliance

Conclusion: Strategic Residency as a Wealth Preservation Tool

The data clearly demonstrates that fiscal residency choice can impact Bitcoin inheritance planning by hundreds of thousands or even millions of euros. The key findings:

- Luxembourg emerges as the optimal choice for complex multi-generational Bitcoin wealth transfers

- France offers superior spousal protection but less favorable treatment for others

- Belgium's system heavily penalizes non-immediate family transfers

- The Netherlands provides simplicity but moderate rates across all relationships

For Bitcoin holders with significant digital assets, the inheritance tax implications of residency choice demand careful consideration alongside other factors like lifestyle, business needs, and regulatory environment.

The key is to begin this planning early, as residency changes require genuine commitment and time to establish. Your Bitcoin legacy planning should integrate tax optimization with practical succession strategies to ensure your digital wealth serves future generations as intended.

This analysis is for educational purposes and should not be considered specific tax advice. Always consult with qualified tax professionals familiar with your specific circumstances and the latest regulatory developments in cryptocurrency taxation.